TLDR

- Circle went public last week. The stock price soared higher than any meme coin.

- Rumors are starting to circulate about the next company to IPO.

- Some would love to see Tether. But they will probably never go public. Keep reading to see where we’re placing our bets.

The world of cryptocurrency has always been a hotbed of speculation, not just about coins and tokens but also the companies behind them. With Circle making its debut on the New York Stock Exchange (NYSE) and rumors circulating about other potential public offerings, the question on everyone’s mind is, “Who’s next?”

Everyone on the internet is speculating. So, we’re going to clear up some things and tell you what we think, without a doubt, the next public crypto is going to be. And we’re pretty sure we’re right. Let’s get after it.

Circle’s Big Day on the NYSE

Circle, the company behind the popular stablecoin USDC, went public on June 5. On its first trading day, Circle’s stock soared, reflecting growing investor interest in regulated stablecoins and trust in the company’s leadership. It went live at $31 and closed up on Friday at $115. The old meme about “Wen USDC to the moon?” isn’t aging well…

Circle’s debut has Wall Street doing a double-take. Once a fringe industry, crypto is now stepping into the mainstream through traditional financial markets.

The company’s decision to go public sparked a fresh wave of curiosity about which other crypto projects might follow suit. After all, a successful public listing can unlock greater transparency, liquidity, and capital for growth.

So who’s it going to be? Let’s look at what many think is the obvious choice.

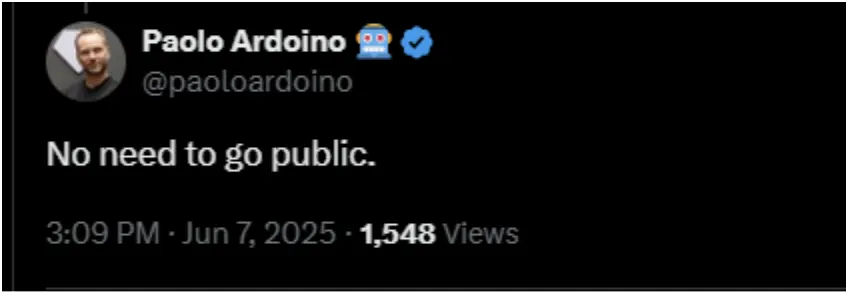

Tether’s Refusal to Join the Public Market

While some crypto firms are eager to make the leap to public markets, Tether isn’t one of them. Just days after Circle’s NYSE debut, Tether CEO Paolo Ardoino made it clear they have no plans to do the same, saying simply, “No need to go public.”

Tether, which issues USDT, the world’s largest stablecoin by market capitalization, remains an enigma in many ways.

USDT has a staggering $154.83 billion as of this writing. That’s just their stablecoins in circulation (which are almost entirely backed by T-Bills), dear readers. It does not include other holdings of volatile assets, gold, or investments in other companies.

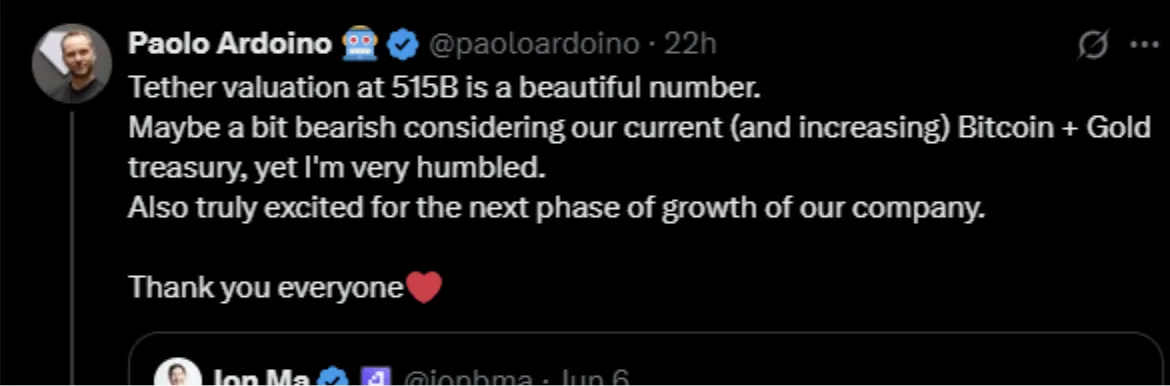

The CEO of a crypto project called Artemis recently valued the company at $515 billion. Ardoino stated that $515 billion might actually be “bearish” given their growing Bitcoin and gold reserves.

As far as mic drops go, that’s not bad.

However, that “bearish” figure would place Tether among the giants of the corporate world, alongside companies like Netflix and Mastercard. No big deal…

For now, Tether appears content to remain private, fueling speculation that it prefers to avoid the scrutiny and regulatory burden associated with being a publicly traded company.

Our Take? Gemini — Plans Are Already in Motion

While Tether may be sitting out the IPO frenzy, Gemini is stepping into the spotlight. On June 7, Gemini released a statement announcing the confidential filing of a draft registration for a potential public offering.

Although specific details, like share price and offering size, remain under wraps, it’s clear Gemini is positioning itself as a major contender in the crypto IPO race. Before you guys start looking to add Gemini stock to your watchlist, keep in mind that this is a draft that was submitted. It’s the first step. Not the last.

Founded by the Winklevoss twins, Gemini is a well-known U.S.-based cryptocurrency exchange with a reputation for adhering to regulatory-friendly practices. Its move toward going public aligns with its broader mission of bringing crypto to mainstream audiences.

For investors, a Gemini IPO could provide a unique opportunity to gain exposure to the cryptocurrency exchange market.

We think this is the right time for Gemini to make the move. With increasing interest in regulated exchanges and the ongoing push for broader adoption of digital assets, Gemini could capture a nice chunk of the market interest.

Why Do These Companies Want to Go Public?

For crypto companies, taking the leap to IPO offers both opportunities and challenges. On one hand, going public provides access to a broader pool of capital and enhances transparency, which can help build trust among investors and regulators. It also offers liquidity for early investors and employees.

Venture Capitalists don’t invest out of kindness. They’re not running charities. They want to see a return.

On the other hand, being a publicly traded company subjects firms to stricter regulatory oversight, quarterly reporting requirements, and the demands of appeasing shareholders. For some, like Tether, the trade-offs may simply outweigh the benefits.

What Does That Mean for the Crypto Industry?

The trend of crypto companies going public represents a pretty big leap in the industry’s maturation process. What was once the domain of tech enthusiasts and early adopters is now intertwining with traditional financial markets.

For beginner crypto investors, this shift adds a new layer of legitimacy to the space (along with some additional diversification options). Seeing companies like Circle and potentially Gemini on the NYSE shows crypto is not just maturing, but evolving.

It also opens up new opportunities for individuals who may be hesitant to invest in cryptocurrencies directly. Buying shares in publicly traded crypto companies allows investors to engage with the industry without navigating the complexities of wallets and exchanges.

Keep an Eye on the Public Markets

Even if you’re strictly focused on crypto or decentralized finance, it’s a good idea to keep an eye on public markets. With Circle’s success, Gemini’s upcoming efforts, and speculation surrounding other major players, the crypto IPO landscape promises to be an intriguing space to watch.

These developments could shape the future of crypto adoption and integration.

Luckily, you don’t need ten monitors. You don’t need to add every news outlet to an aggregator to stay informed. You’ve got Dypto Crypto.

The future of finance is unfolding, and we’re here to help with guides and regular news coverage of what matters most to the industry and the users that make it one.