Many people who are getting into crypto, especially young people, are seeing some unfamiliar things. If you’re new to finance, paying attention to financial news all across the globe can be more overwhelming than crypto itself.

You bought some ETH and BTC, and now you see names like Powell and Gensler. You feel like you have to pay attention more because, in crypto, you’re in control of your funds and responsible for protecting them as best you can. And you’re completely right.

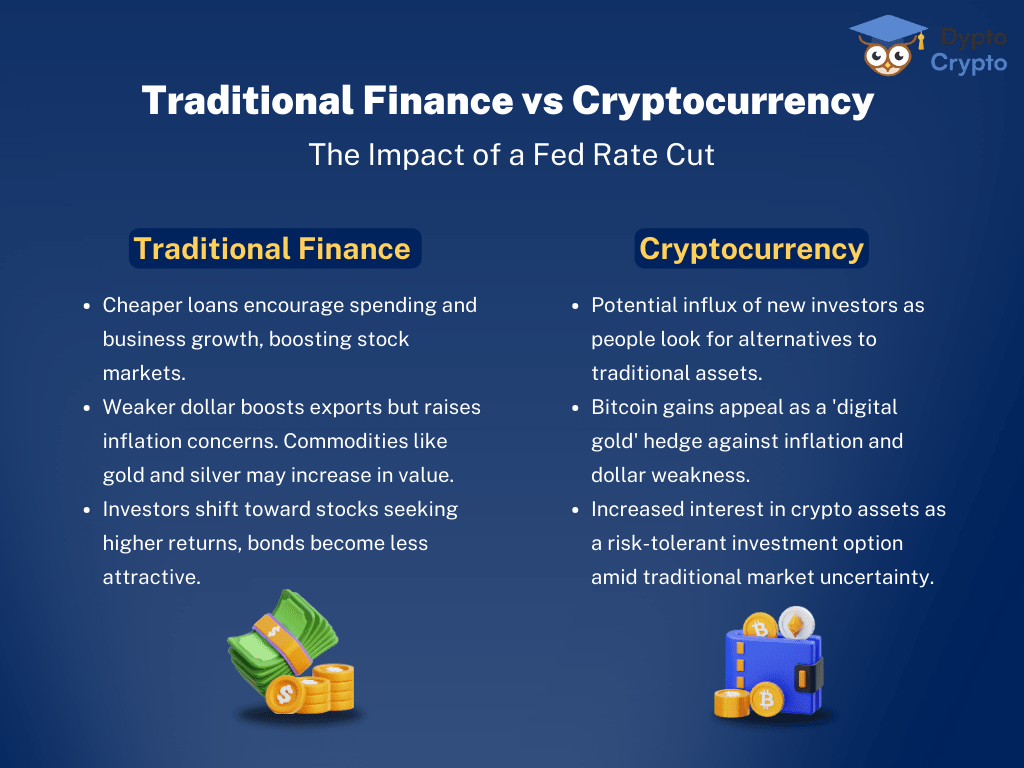

The Federal Reserve just made a major move by cutting interest rates for the first time in four years. This Fed rate cut news is a huge deal. What does this mean for your wallet, the global economy, and that shiny Bitcoin in your portfolio?

Spoiler alert: it’s a bit of a rollercoaster!

The Fed Rate Cut News – What’s the Big Deal?

Let’s start with a quick rundown of what the Fed rate cut news actually means. When the Fed chops interest rates, borrowing becomes cheaper, and spending is encouraged.

The Federal Reserve makes this decision when it sees an economy cooling off and wants it to start warming back up. A rate cut can energize the economy, but it also comes with a potential inflation risk.

For investors and savers, this is where things get spicy. Low rates benefit borrowers but might not sit well with lenders and anyone with a savings account.

In the grand scheme of the economy, this rate cut impacts everything from mortgages to credit cards. It’s like a giant ripple effect, influencing borrowing trends, spending habits, and even your favorite coffee shop’s decision to expand into soy-latte territory – just in time for pumpkin-spice season!

How Should New Investors Pivot With an Expected Fed Rate Cut?

So, should you sell all of your BTC or SOL into this pump? We’re not saying that. An expected Fed rate cut is a big deal, but it isn’t everything.

The cryptocurrency market is still relatively young and not tied directly to traditional financial systems. But that doesn’t mean it’s immune to the effects of a rate cut.

For starters, a drop in interest rates can weaken the US dollar (USD). A weaker USD tends to push up prices for commodities like gold and oil. For crypto investors, this could increase demand for Bitcoin as a hedge against inflation and uncertainty in traditional markets.

With lower interest rates driving more spending, we may see an influx of new investors entering the crypto space. As they look for alternative ways to invest their money, cryptocurrencies may become an attractive option.

However, realistically, we’ll continue to see the moderate volatility we have seen before.

How Does a Rate Cut Affect the Overall Economy?

The Fed’s rate cut is just one piece of a larger economic puzzle. It can impact the economy, but it’s not the only factor at play.

For example, a rate cut may seem like good news for borrowers and consumers, but it could also lead to fears of an economic downturn, meaning it’s a sign of an impending recession. That’s something many “experts” are saying we’re past due to have.

This could cause businesses to hold off on investments and hiring, which could negatively impact job growth and overall economic health.

On the other hand, if the rate cut successfully boosts spending and stimulates the economy, it could lead to increased business activity and job creation.

The Magic Behind the Numbers

Ah, Bitcoin! The digital coin that’s got everyone buzzing, giving the media something to lie about/pretend they know about, and probably the reason that led you down the internet rabbit hole to Dypto Crypto.

*slow turn*

Oh hai.

The Fed’s announcement sent Bitcoin’s price soaring back into the mid 60,000’s, causing quite a stir.

Why? Well, when interest rates drop, people tend to flock to riskier assets like stocks and, you guessed it, crypto. It’s like having a sale on skydiving gear; suddenly, everyone wants to jump in! Or jump out. We probably should have come up with a better analogy there…

Experts are whispering about Bitcoin smashing through its all-time high. Because that’s what “experts” do. It’s either going to a million or it’s going to zero. Talk about sensationalism!

But, like any good thriller, there’s a plot twist. The upcoming election could throw a wrench in the works. Depending on who wins, Bitcoin’s future might look very different. We’ll have a separate article on that coming out soon.

The Expected Fed Rate Cut and the Ripple Effect

Bitcoin isn’t the only player in the crypto game. The expected Fed rate cut that became a reality will likely shake up the whole crypto market, nudging investors to consider their next move.

With Ethereum, Solana, and other altcoins joining the pricing party, it’s a great time to see how these shifts could affect your crypto strategy.

Traditional financial markets and crypto are getting cozier, too. This intimate dance means that when one moves, the other follows. Investors need to monitor these interactions to make informed decisions.

Always Proceed With Caution

Before you start dreaming of early retirement, remember that this market is as unpredictable as a cat on catnip.

While the Bitcoin rally is exciting, it’s not without its risks. Political uncertainties, like the election, can turn things upside down, and global economic challenges could rain on this parade. Right now, we’re already seeing a correction. But “Uptober” is here. So it’s hard to tell what will happen as elect day draws closer.

Keep a level head. Even though the crypto market is buzzing, it’s essential to watch out for pitfalls hindering the rally’s progress.

The Future of Crypto in a Post-Rate-Cut World

What does the future hold for crypto enthusiasts?

With the Fed’s decision shaking things up, the possibilities are both unpredictable and infinite. We aren’t fortune tellers. If we were, we’d be sitting at home counting money instead of writing this article.

However, we can make some decent guesses based on history.

Long-term effects could include more investors leaning into digital assets as traditional markets adapt. Institutional players could use the pump to take profits and then buy the dip, as they now have enough footing to influence the market as a whole.

This is also the time we expect innovation to erupt. Historically, many protocols have been launched around this time, and old projects have released new products as well. So, while we don’t know exactly what will happen, we fully expect Q4 to be exciting and fun to watch.

Still, investors and newbies alike must stay informed and agile. Monitor market trends and seek insights from more experienced traders.

The Big Fed Rate Cut News Won’t Impact Your Crypto Portfolio in the Long-Term

Navigating the crypto world is akin to surfing the wildest waves — a thrilling ride peppered with unpredictability and potential rewards.

The Fed rate cut news may jolt the financial ocean, causing ripples across traditional and crypto markets. While seasoned investors might view volatility as part of the adventure, newcomers should strap in and stay alert.

If you’re new to investing, remember that an expected Fed rate cut is not a reason to panic. Stay the course, do your research, and have faith in yourself.

Understanding the dynamic between macroeconomic events and digital currencies can guide your decisions, especially as political landscapes shift and new crypto innovations emerge. Keep your eyes peeled and your strategies flexible. After all, in the high-octane world of crypto, adaptability is the closest thing to a safety net.