TLDR

- Semler Scientific is a Bitcoin Treasury Company and healthcare innovator.

- The company now owns more than 4,000 BTC.

- It is ranked 13th for publicly traded treasury businesses.

You guys know Strategy. MetaPlanet. Mara Holdings. Cleanspark. But what about Semler Scientific? While the most popular names in the publicly-traded companies that love BTC as much as we do list (we just made that up) always make the headlines, it’s easy to forget they aren’t the only ones buying up digital gold.

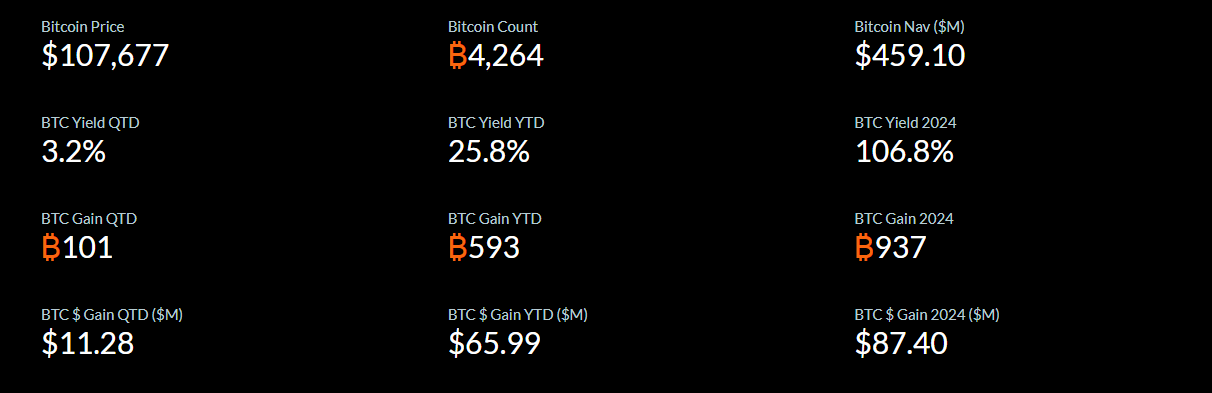

Semler Scientific, a Nasdaq-listed healthcare technology company, has now firmly positioned itself as a notable corporate Bitcoin holder. With its latest acquisition of 455 BTC for $50 million, the company’s Bitcoin assets have surged to a total of 4,264 BTC. The purchase is part of Semler Scientific’s wider financial strategy to safeguard shareholder value and leverage the potential long-term benefits of Bitcoin.

Between May 13 and May 22, 2025, Semler Scientific made its latest purchase at an average price of $109,801 per Bitcoin, funded through its $500 million at-the-market offering program. The recent buy cements Bitcoin as the company’s treasury reserve mainstay, showcasing its confidence in the cryptocurrency as a hedge against inflation and economic uncertainty.

Why Bitcoin Matters to Semler Scientific

Semler Scientific develops and markets healthcare products that aid in the detection and treatment of chronic diseases, but their growing Bitcoin strategy has drawn significant attention beyond the healthcare sphere.

The company’s foray into Bitcoin began in May 2024, driven by Bitcoin’s finite supply, its utility as a store of value, and its ability to counter the risks of fiat currency devaluation. The company website has a Bitcoin logo and the phrase “Empower early detection. Backed by Bitcoin”. These guys are Saylor-serious.

The latest 8-K filing from Semler reveals additional details about its Bitcoin positioning. The firm’s Bitcoin holdings, acquired at a total of $390 million with an average cost of $91,471 per Bitcoin, now have a market value of $474.4 million as of May 22, 2025.

Semler also disclosed a year-to-date Bitcoin yield of 25.8 percent, underscoring the financial success of this treasury strategy. While the market fluctuates, here’s what is on their website at the time of this writing:

By adopting Bitcoin, Semler joins a cadre of companies exploring cryptocurrency as a key part of balance sheet diversification. While it’s not unusual for fintech or tech companies to adopt such measures, Semler stands out as one of the few publicly traded healthcare firms to integrate Bitcoin into its financial strategy.

Tracking Semler’s Bitcoin Momentum

Semler’s Bitcoin acquisition strategy has been highly active over the past year, highlighting a clear intent to grow its cryptocurrency reserves. Recent milestones include:

- February 4, 2025: Acquired an additional 871 BTC.

- January 13, 2025: Purchased 237 BTC.

- December 2024: Acquired 514 BTC across separate purchases in December.

- November 22, 2024: Secured 297 BTC at $97,995 per Bitcoin, totaling $29.1 million.

The proactive buying spree is not purely speculative. It’s a calculated approach to integrating Bitcoin as a financial resilience tool in uncertain economic environments.

While market volatility has been a major consideration, the company appears to view Bitcoin’s potential upside as outweighing its risks.

According to Bitcoin Treasuries, Semler Scientific ranks 13th among publicly traded companies holding BTC. Like the companies mentioned at the beginning of this piece, it is an official Bitcoin Treasury Company. If you like what you’re reading here, it might be worth adding them to your watchlist.

Bitcoin’s Role in the Healthcare Sector

Semler’s pivot to Bitcoin reflects a broader acceptance of cryptocurrencies among U.S. corporations. Though publicly traded healthcare companies with large-scale Bitcoin holdings are still rare, Semler’s decision speaks to a strategic evolution within the industry.

Where other firms may use Bitcoin as a hedge for economic downturns or inflationary environments, Semler’s focus appears to be stability and long-term value enhancement for shareholders. It’s especially intriguing in the context of a healthcare company, where operational focus is traditionally centered on patient care and technological innovation.

Evaluating Outcomes of Semler’s Treasury Strategy

The financial disclosures tied to Semler’s Bitcoin strategy reveal both challenges and triumphs. The company has reaped massive unrealized gains with a market value of $474.4 million against a $390 million initial investment. However, the volatility of the Bitcoin market makes a big fat question mark.

Semler uses its own custom measure, Bitcoin Yield, to assess the performance of its digital asset strategy. The year-to-date yield of 25.8 percent reflects not only the increases in Bitcoin’s market value but also the efficacy of Semler’s acquisition timing.

The company attributes its approach to a wider trend of businesses safeguarding against inflation while capitalizing on Bitcoin’s growth potential. While the healthcare sector’s traditionally risk-averse nature makes Semler’s Bitcoin adoption atypical, the company’s leadership continues to argue that the risks are mitigated by the potential rewards.

Not All Sunshine and Rainbows

Despite its strong growth and confidence in Bitcoin as a treasury reserve, Semler faces inherent risks. Bitcoin’s price volatility remains a consideration, and the broader cryptocurrency market is not immune to regulatory scrutiny or macroeconomic pressures.

Investors in the healthcare sector, which leans heavily on predictable financial reserves for funding research, product development, and operations, may find these risks a little too rich for their blood.

On the flip side, if Semler’s strategic bet on Bitcoin continues to yield positive returns, it could serve as a case study for other firms exploring similar moves.

Semler Scientific Is Betting on the Big Picture

Semler Scientific’s increasing Bitcoin holdings exemplify the ongoing wave of corporate cryptocurrency adoption. Positioned as an unusual but forward-thinking healthcare company, its Bitcoin treasury strategy has already set it apart.

This milestone of surpassing 4,000 BTC underscores the company’s commitment to implementing a long-term approach.

With its combination of healthcare expertise and financial innovation, Semler’s story serves as a reminder that Bitcoin’s use case continues to expand beyond tech and finance into new, uncharted sectors.