What is Open Interest?

Open interest refers to the total number of open derivative contracts, like options or futures. Open derivative contracts are those which have not been settled.

The Long Definition

Open interest (OI) is the total number of outstanding derivative contracts held by market participants. These are positions that traders have opened but are yet to close.

OI is usually calculated at the end of each day in the futures and options market. It is considered an important indicator of the liquidity of a contract. It can also be used to predict the direction of a trend.

Open Interest Explained

Open interest measures the total number of unsettled options or futures contracts at the end of the day. These contracts are active buy or sell positions that have not been closed. Therefore, open interest changes as traders initiate and close positions in the market.

It increases when the number of positions opened by traders and investors is higher than the number of contracts closed. The total at the end of the day is carried over to the next day. Here’s an example;

Note that this is a row-resolution example. In the real world, things are much more complex.

Assume that on Monday morning, OI on Bitcoin (BTC) futures on Binance is 0. During the day, investors buy 100 future contracts. 50 of these are closed before the day’s end. So, OI from BTC futures at the end of Monday will be 50.

On Tuesday, 35 contracts are closed and 70 new contracts are opened. So, at the end of Tuesday, the OI will be 85 contracts (70 + 50 – 35).

Closing a position typically involves an offsetting transaction. This is a transaction that cancels out the effects of the earlier action, For instance, the offsetting transaction would be selling for an investor who bought an options contract. By selling their contract, they close their position.

Why is Open Interest Important?

Open interest is a good measure of how much money and activity there is in an options or futures market. A high OI means that there are many open contracts. Therefore, there is a high level of trading activity– a large number of participants have an interest in the underlying asset.

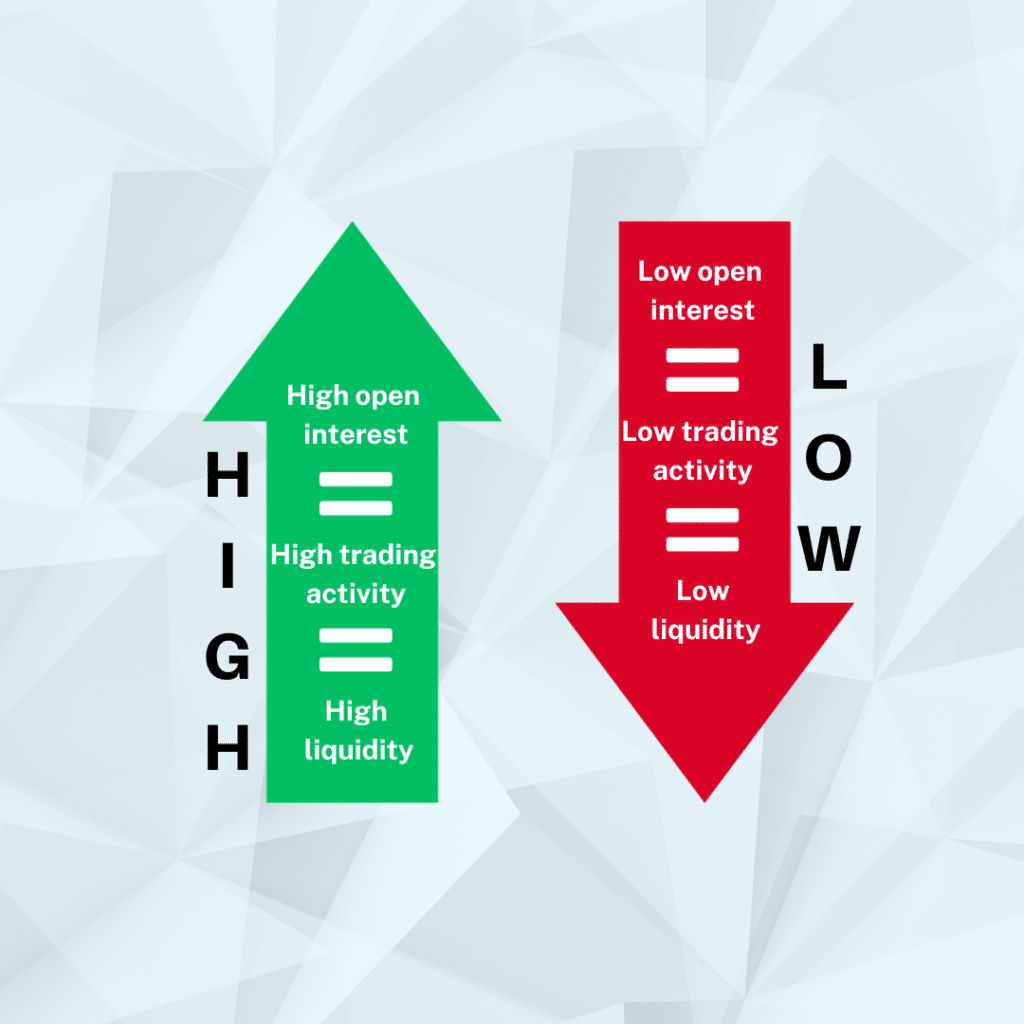

Following the same line of thought, OI offers a reflection of the level of liquidity in the market. High open interest equals high trading activity, which equals high liquidity. The opposite is true– the lower the open interest, the quieter the market, and the lower the liquidity.

With this in mind, investors can measure the flow of money using the change in OI. Increasing OI indicates that new traders are entering positions over time. Therefore, new money is coming into the market. Similarly, decreasing OIt is a sign that money is flowing out of the market.

Open interest can also gauge whether a particular trend will continue. How?

Rising OI shows increased activity in the market. This is generally interpreted as a sign that the existing market trend will continue. On the other hand, falling OI shows reduced activity. So, the existing trend is losing momentum and may not continue.

For example, if BTC prices are rising, increasing OI may signal more price jumps. The same applies to falling prices. If the value of BTC is falling, declining OI favors further price declines.

However, none of that should be interpreted as a sign of a bear or bull market. Open interest alone cannot signal the beginning or end of a bear/bull market.

Want to join the Dypto journey? Follow our socials!