What is Deflation?

Deflation refers to a decline in the prices of goods and services.

The Long Definition

Deflation is the general decline in prices for goods and services in an economy. It is characterized by an increasing purchasing power of money. This means that you can buy more with the same amount of money over time.

Deflation usually accompanies a reduction in the total amount of money circulating in an economy. However, it can also be caused by increased productivity, decreased demand, and technological advances.

In the context of cryptocurrencies, deflation refers to a general decline in the supply of coins/tokens over time. This, it is assumed, causes the value of the digital currency to increase.

History of Deflation

Periods of deflation have occurred for as long as trade has existed. The US itself has experienced several significant deflationary periods. These are:

- 1815 – 1860: Prices of goods continued dropping for several decades due to the rise of industrial mechanization resulting in an increase in production.

- 1873 – 1879: Prices dropped every year due to increased production. This period is known by historians as ‘The Long Depression.’

- 1930 – 1933: Prices dropped by an average of 7% every year. Unlike in prior periods, deflation was caused by a collapsing financial sector. This period is known as ‘The Great Depression.’

- 2007 – 2009: Commodity prices dropped between December 2007 and June 2009. This period is known as ‘The Great Recession.’

Deflation in the Economy

Deflation is characterized by a decrease in the prices of goods and services over time. Think of it as a scenario where money is worth more over time. Let’s say $500 dollars buys you two pairs of shoes today. After a deflationary period, it might buy you three pairs of shoes.

Deflation occurs due to a decrease in the supply of money without a corresponding decrease in economic output. Since the money supply is controlled by the central bank, deflation can occur due to central bank policies.

However, the supply of money can also fall due to catastrophic bank failures. This is what happened during The Great Depression in the United States.

Other causes of deflation include:

- Increased production: When more goods are produced, their supply increases. If the demand remains constant, more supply saturates the market, resulting in lower prices.

- Decreased demand: This means that fewer people are willing to buy goods and services. When that happens, assuming the production remains constant, prices will drop.

- Technological advancements: The tech sector experiences its own form of price deflation. As science and production techniques advance, tech products get cheaper with time.

Generally, falling prices over a prolonged period seem like a good thing. However, economists point out that this will harm some sectors and players in the economy.

For instance, it makes borrowing less economical. This is because as prices fall, debt repayments become worth more than the money that was actually borrowed. So, governments, companies, and individuals that rely on debt financing may struggle due to deflation.

Deflation in Cryptocurrency

Deflation does to a digital currency the same thing it does to money – increases its value over time. As a result, deflation is a highly sought-after condition in the crypto space. Many cryptocurrencies and crypto tokens have assumed deflationary models.

Generally, a cryptocurrency achieves deflation by reducing its supply. Assuming the demand increases or remains constant, this should push the price of each individual coin or token upwards.

Buyback and Burn

Most digital currencies try to “deflate” by using the buyback and burn model. It involves developers removing a large number of coins/tokens by buying them back. They then send them to a wallet outside the blockchain. This practice is known as ‘burning cryptocurrencies.’

BNB is a good example of cryptocurrency using this model. Binance, the crypto exchange behind BNB, burns BNB in an effort to reduce its token supply to 100 million.

Is Bitcoin Deflationary?

Bitcoin (BTC) is designed so that its supply will not exceed 21 million. To achieve this, the digital asset halves its block reward every four years. The block reward is essentially a way through which new bitcoins enter circulation. Currently, it stands at 6.25 BTC. Four years ago, it was 12.5 BTC, and four years from now it will be 3.125 BTC.

Bitcoin is reducing the rate at which new bitcoins are created. This may make the coin seem deflationary, but technically, it isn’t. This is because new bitcoins are still entering circulation. Therefore, the supply of bitcoin is increasing with time.

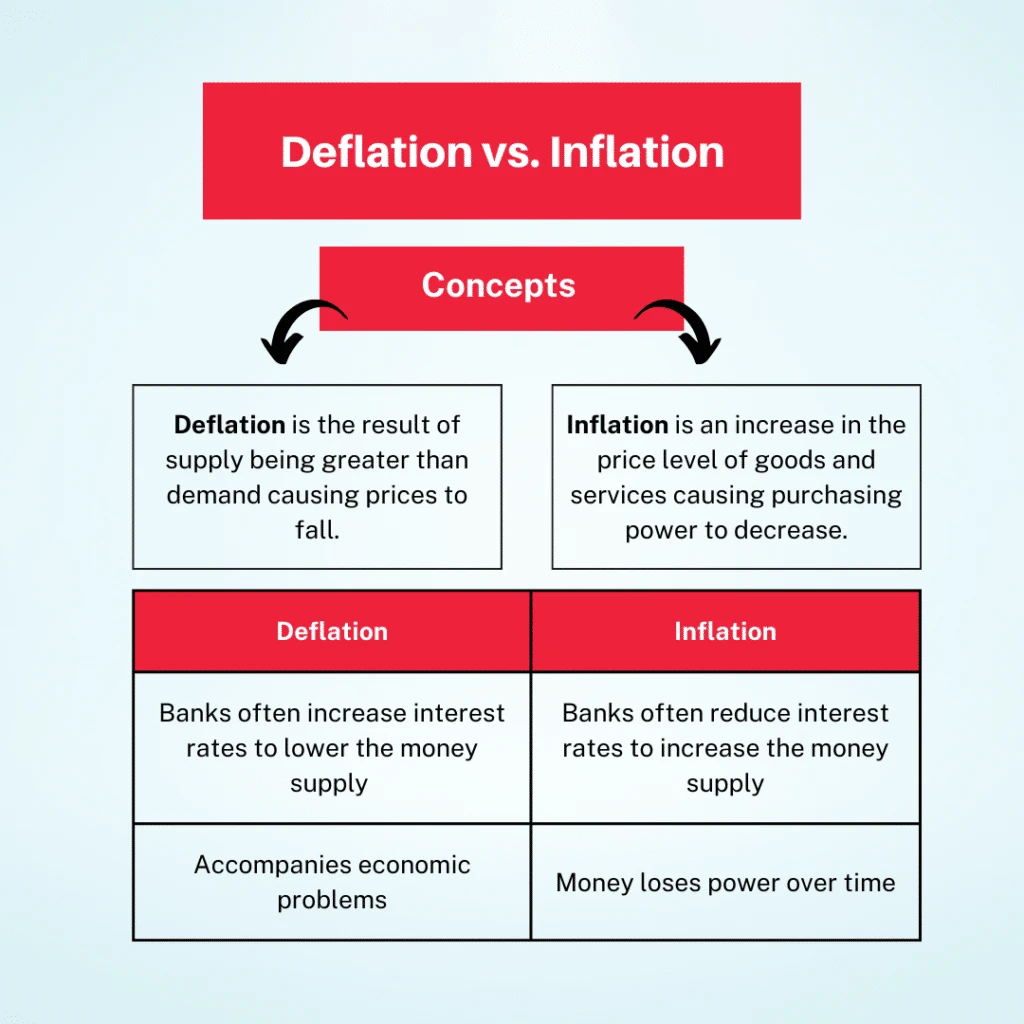

Deflation vs Inflation

Inflation is the opposite of deflation. It is characterized by rising prices and typically accompanies an increase in the supply of money or financial assets.

In crypto, deflation is viewed as a better thing than inflation. This is because while deflation increases the value of a particular token, inflation reduces it.