What is Uniswap?

Uniswap is a decentralized exchange (DEX) that lets users swap between ERC-20 tokens without needing trusted intermediaries. It is available on several blockchains, including Ethereum, Optimism, Arbitrum, Polygon, Base, BNB Chain, Avalanche, and Celo.

Uniswap pioneered the use of Automated Market Makers (AMMs) over order books in DEXs. In the AMM model, smart contracts and liquidity pools of two assets replace buy and sell orders. Market rates are adjusted dynamically as trades occur.

Uniswap’s permissionless model ensures unrestricted public access, democratizing participation beyond traditional geographic, wealth, or age-based restrictions. It facilitates liquidity provision, token swapping, and the creation of new markets, and its immutable design ensures that its operation cannot be altered.

Segue: Uniswap is radically different from traditional crypto exchanges. Here’s a look at the various components that make it what it is.

What is unique about Uniswap?

UNI

Uniswap (UNI) is an ERC-20 token that serves as the protocol’s utility token. It is used in governance, liquidity provision, rewards, and fees.

As a governance token, UNI determines the weight of a user’s voting rights. The more UNI a user has in their wallet, the more weight their delegation or vote on a proposal holds.

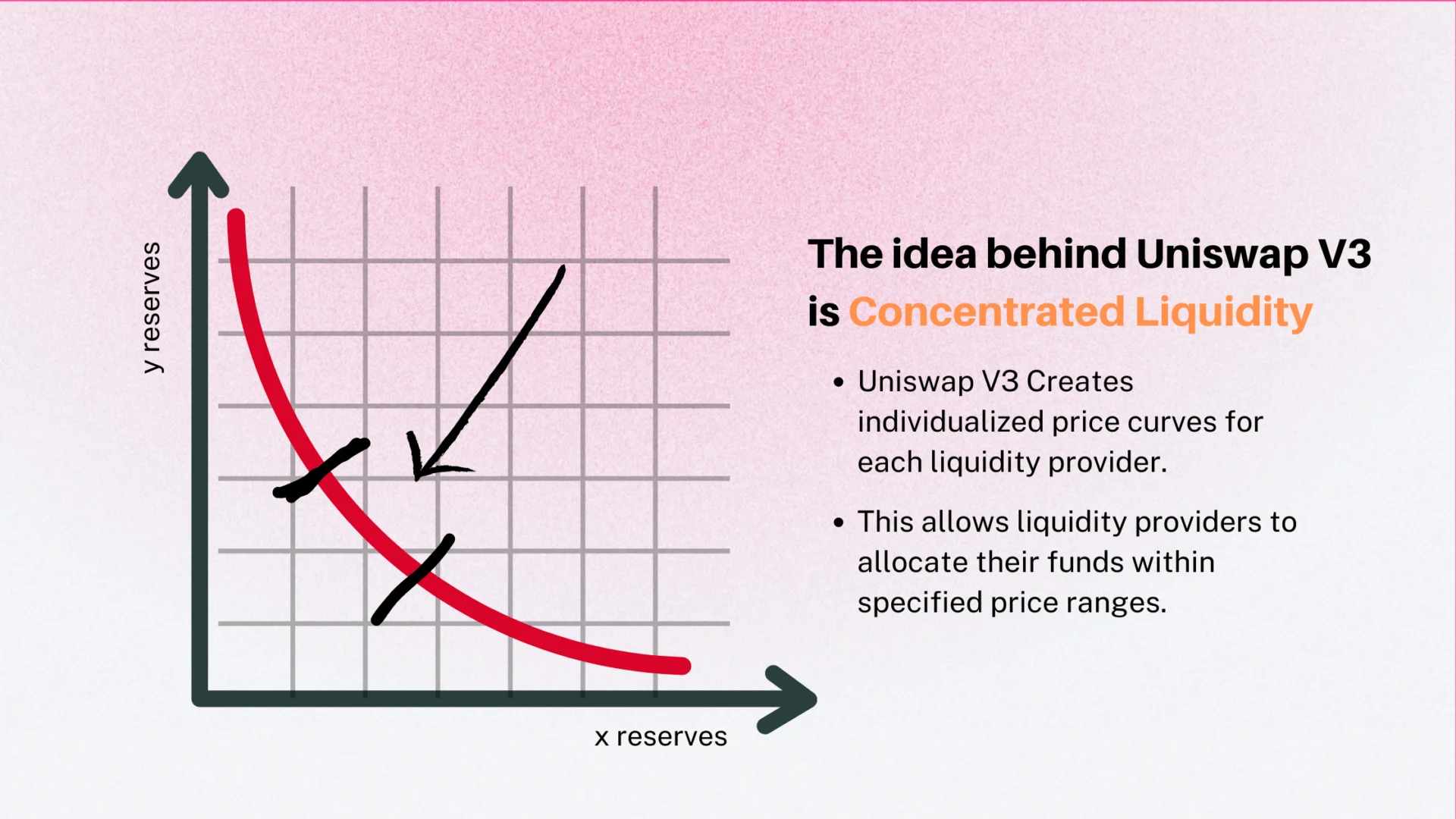

Concentrated liquidity

Uniswap features concentrated liquidity that allows liquidity providers to allocate their funds to specific price ranges. This feature increases capital efficiency by focusing liquidity where it’s needed, resulting in better trading fees for liquidity providers.

Automated Market Making (AMM)

Unlike traditional exchanges, which use an order book to match buyers and sellers, AMMs use smart contracts that allow users to trade directly with a pool of assets. These pools are known as liquidity pools, and the assets they contain come from other users. They guarantee liquidity and allow trades to happen anytime, regardless of size.

Segue: Uniswap’s unique feature allows you to conduct various operations on the platform that are not limited to trading.

What can I use Uniswap for?

Token Swapping

This is trading in the traditional sense; you can exchange one ERC-20 token for another. It is the primary function of Uniswap. Since the protocol is permissionless, this can be done easily without an account or KYC process.

Liquidity Provision

Assets in a liquidity pool are contributed by users, known as liquidity providers, who are rewarded in return. You can become a liquidity provider by depositing an equivalent value of two tokens into a liquidity pool. This earns you rewards paid from the fees charged on the trades that occur within the pool.

Yield Farming

You will be rewarded for providing liquidity. If you want more rewards, you can use these rewards to make even more profit. Such acts are collectively known as yield farming.

In this case, the fees earned from liquidity provision can be reinvested to generate even more yield.

Price Information

Uniswap’s interface provides information about the current price of tokens and the history of their prices.

Launchpad for New Tokens

Many projects choose to launch their tokens on Uniswap due to its permissionless nature. This allows users to buy these tokens as soon as they are launched.

Arbitrage Opportunities

The price of a token can sometimes vary between Uniswap and other exchanges. Let us assume ETH is worth $1800 on Uniswap and $1802 on Pancake Swap, another DEX. This creates an opportunity for a practice called arbitrage, where the trader takes advantage of the price differences between different platforms to make a profit.

In this case, they would buy ETH on Uniswap and sell it on Pancake Swap.

Participate in Governance

If you hold UNI, Uniswap’s governance token, you can participate in decisions about the protocol’s future. This includes voting on proposals related to Uniswap’s development.