What is Radiant?

Radiant is an innovative DeFi (Decentralized Finance) protocol designed to unify and streamline borrowing and lending within the cryptocurrency market. It achieves this by offering an omnichain money market environment, allowing users to effortlessly deposit and borrow digital assets across various blockchain networks. This cross-chain functionality breaks down the barriers between isolated blockchain platforms, making the transfer and management of assets more fluid and user-friendly.

Governance on Radiant is handled by its Decentralized Autonomous Organization (DAO). This is done to ensure that decision-making is democratized and in the hands of the community. The platform utilizes its native utility token, RDNT, as a tool to engage and incentivize users. This token facilitates a range of platform interactions, rewarding users not just for their participation but also for contributing to the platform’s liquidity and stability through borrowing activities and payment of platform fees. By integrating these features, Radiant aims to create a more cohesive, efficient, and user-centric DeFi ecosystem.

There are many other lending and borrowing platforms in DeFi. What is it that sets Radiant apart?

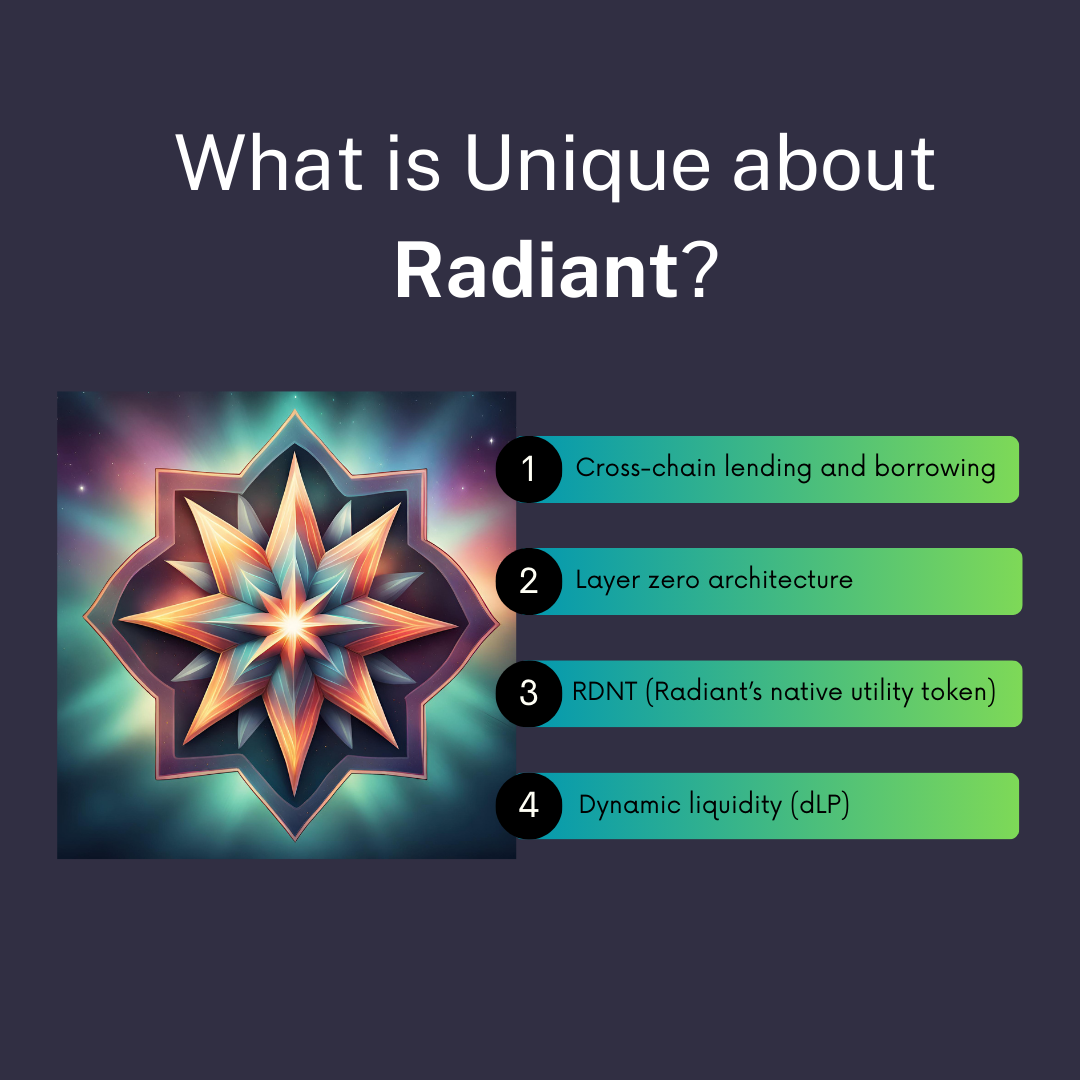

What is unique about Radiant?

- Cross-chain lending/borrowing: Radiant is an omnichain money market. This means it allows users to deposit an asset on one blockchain and borrow supported assets from a different blockchain.

- Layer Zero architecture: Layer Zero, a foundational communication layer, facilitates seamless interoperability between different blockchain networks, enabling efficient asset transfers across its platform.

- RDNT: This is Radiant’s native utility token. It is an omnichain fungible token (OFT) that facilitates native, cross-chain token transfers, promoting interoperability between different blockchains.

- Dynamic Liquidity (dLP): dLP tokens can be locked through the protocol to activate RDNT emissions in the money market, receive protocol revenue, and provide governance voting power.

With that in mind, here’s a look at what Radiant’s unique features allow you to do on the protocol.

What can I use Radiant for?

- Lend Assets: supply assets for borrowing to earn yield. This yield is derived from the interest paid by borrowers.

- Borrow: unlock liquidity without having to sell your crypto assets. Note that you can conduct both lending and borrowing on multiple chains thanks to Radiant’s cross-chain interoperability.

- Earn Protocol Emissions: Provide Dynamic Liquidity by locking RDNT to earn protocol emissions from your supplied or borrowed assets.

Want to join the Dypto journey? Follow our socials!