What is Pendle?

Pendle is a decentralized finance (DeFi) platform that allows users to separate yield-bearing assets into yield and principal components. It essentially allows users to tokenize and sell future yields. This offers investors new strategies for yield optimization.

The platform features a specialized automated market maker (AMM) designed for yield trading. It also supports locking $PENDLE for protocol stake and promotes fixed yields without lock-up periods to give users control over their investments.

Pendle operates cross-chain and undergoes regular audits to ensure security.

Overall, there are 3 defining features of Pendle:

- Yield Tokenization: Pendle turns yield-bearing tokens into standardized yield (SY) tokens. SY tokens are wrapped versions of the underlying yield-bearing tokens. They are compatible with the AMM.

For example, staked ether (stETH) becomes SY-stETH.

SY tokens are then split into principal (PT) and yield (YT) tokens, a process called yield-tokenization that separates the yield into a separate token.

- Pendle AMM: The AMM has been specially designed for trading yield. Users can trade both PT and YT on it. PT can be directly traded with SY on PT/SY pools while YT trades occur via flash swaps.

Overall, the AMM is the core engine of Pendle. However, you don’t really need to understand it to trade PT and YT.

- VePendle: Users can also lock PENDLE for vePENDLE. The greater the lock duration, the greater your vePENDLE value.

- vePENDLE is used as a governance token. Holders vote on proposals and matters affecting the protocol. The more vePENDLE one has, the greater their voting power.

- vePENDLE is used to incentivize liquidity in pools since holders can vote to direct rewards flow to a particular pool. Holders are entitled to 80% of the swap fees of pools they vote for.

- vePENDLE holders also earn protocol revenue from swap and YT fees.

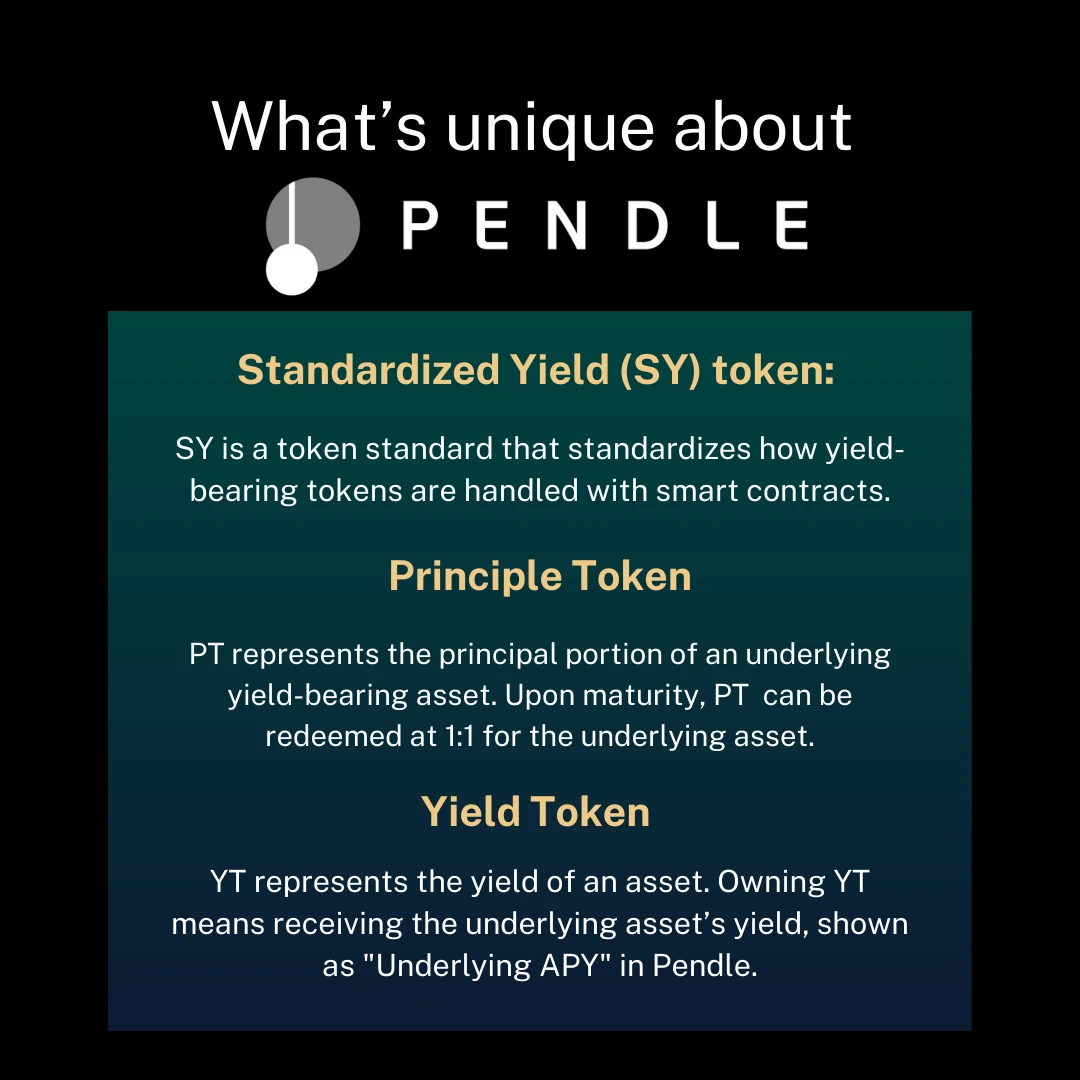

What is unique about Pendle?

Pendle’s most unique feature is its ability to separate the principal from the yield of a yield-bearing token.

- Standardized Yield (SY) token: SY is a token standard that standardizes how yield-bearing tokens are handled within smart contracts. This means different types of yield-bearing tokens, such as stETH, cDAI, and yvUSDC, can be wrapped into SY tokens, which can then be used interchangeably on the Pendle platform.

The ultimate goal of SY is to create greater composability across all of DeFi, enabling developers to easily build on existing contracts without the need for manual integration.

- Principal Token: PT represents the principal portion of an underlying yield-bearing asset. Upon maturity, PT can be redeemed at 1:1 for the underlying asset (e.g., 1 PT-stETH is redeemed for 1 ETH worth of stETH).

- Yield Token: YT represents the yield of an asset. Owning YT means receiving the underlying asset’s yield, shown as “Underlying APY” in Pendle. For instance, having 10 YT-stETH gets you all the yield from 10 ETH in Lido.

All these parts combine to let you do a variety of things on Pendle.

What can I use Pendle for?

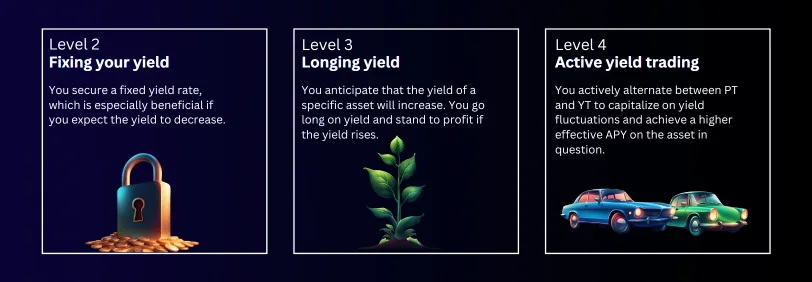

- Yield Tokenization: You can tokenize the future yield of your interest-bearing assets. This means the yield an asset would earn in the future can be converted into a token and traded.

- Yield Trading: After tokenizing your yield, you can trade it in the Pendle markets. This allows for speculation on future yield rates and gives you the flexibility to liquidate your future yield before it is actually realized.

- Risk Management: you can choose to sell the future yield of an asset if you believe the return rates will drop in the future. This lets you lock in your returns ahead of time and mitigate potential losses from falling rates.

- Instant Liquidity: You can sell your future yield now to receive income in the present.

- Liquidity Provision: Pendle protocol also provides yield farming opportunities where you can supply liquidity to the Pendle markets and earn rewards.