TLDR

- ARK has raised its BTC price predictions.

- They now estimate that on the low side, it’ll be worth $500k by 2030. But the bull case? A whopping $2.4 million.

- ARK has its own Bitcoin ETF (ARKB) and holds over 50k Bitcoin.

Bitcoin enthusiasts and investors, take note—ARK Invest has dropped their latest projections for Bitcoin’s future price, and spoiler alert, they’re pretty bullish. According to their newly updated price targets for 2030, Bitcoin could reach up to $2.4 million per coin in their best-case scenario.

But before you start dreaming of Lambo-filled sunsets, let’s break down the data driving these predictions. Time to get after it.

What ARK Invest Is Saying

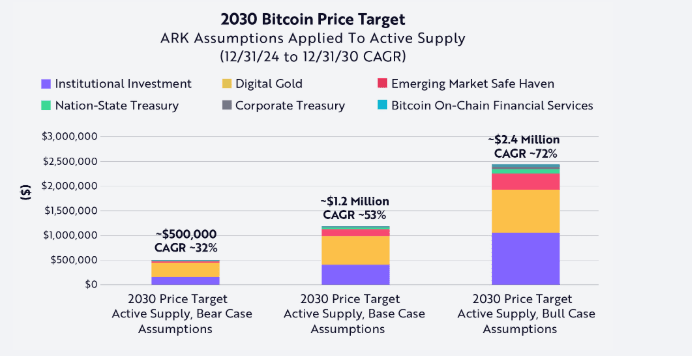

ARK’s research comes with three price scenarios for Bitcoin by 2030:

- Bear Case: $500,000

- Base Case: $1.2 million

- Bull Case: $2.4 million

These numbers are based on Bitcoin’s total addressable market (TAM), its penetration rates, and major contributors to what ARK calls “capital accrual.” Translation? They’re betting on increased adoption across various sectors, from institutional investors to nation-states and even corporate balance sheets.

But there’s a catch (because, of course): ARK’s lofty price targets depend on assumptions about market growth and adoption rates. The targets might prove too optimistic if Bitcoin doesn’t hit these benchmarks.

The Factors Driving ARK’s Projections

ARK bases its evaluation on advanced algorithms and AI modeling. Here are some of the major factors.

1. Digital Gold

Bitcoin as “digital gold” continues to be the backbone of ARK’s valuation model. Currently, gold accounts for around 3.6% of the global portfolio TAM (~$169 trillion). ARK predicts Bitcoin could hit 6.5% of this TAM in their bullish case by 2030. That doubling of gold’s market share is where the “digital gold” narrative really flexes its muscles.

The assumption relies on the idea that Bitcoin can prove itself as a nimbler and more transparent alternative to gold in a global market increasingly wary of inflation and currency devaluation.

2. Institutional Investment

Institutional adoption is another heavy hitter in ARK’s projections. The approval of spot Bitcoin ETFs in major markets could serve as a game-changer. ARK assumes a gradual CAGR (compound annual growth rate) of ~3% for this sector, driven by funds flowing into Bitcoin from institutional portfolios seeking diversification.

Bitcoin ETFs would make it easier for “big money” to invest, potentially driving Bitcoin prices to new heights. While ETFs are already finding traction in some regions, ARK’s predictions count on broader regulatory approval and subsequent adoption.

3. Emerging Market Safe Havens

ARK highlights emerging-market demand as a critical use case for Bitcoin’s growth. When local currencies are underperforming or governments are unstable, Bitcoin offers an appealing alternative.

Combine that with Bitcoin’s low barriers to entry (all you need is internet access), and demand could snowball in developing economies. ARK sees this sector playing a massive role in capital accrual, and for good reason.

4. Nation-State and Corporate Treasury Reserves

ARK also predicts more adoption of Bitcoin in nation-states and corporate treasuries. Countries like El Salvador and Bhutan already hold Bitcoin as part of their national reserves, and ARK anticipates that more will follow suit.

Strategy’s Bitcoin strategy has set a precedent for corporations, potentially encouraging others to diversify stagnant fiat cash on their balance sheets with BTC.

Even in ARK’s base case, this is one area where relatively modest adoption (1-2.5% penetration rates) could drive significant price increases.

5. Bitcoin’s On-Chain Financial Services

Bitcoin’s “Layer 2” solutions, particularly the Lightning Network and even Wrapped Bitcoin (WBTC), are becoming essential parts of the ecosystem. These services enhance Bitcoin’s transaction functionality, enabling it to compete with traditional finance.

ARK projects a CAGR of 40% for on-chain financial services, citing platforms that continue to build on Bitcoin’s utility. This represents one of the more aggressive assumptions driving their bull case.

The Supply Factor

ARK’s prediction isn’t just about demand. On the supply side, they’ve taken Bitcoin’s deterministic issuance schedule into account. By 2030, Bitcoin’s circulating supply will be around 20.5 million coins. However, ARK also hints at another factor that could push prices even higher: the concept of “active supply.”

Bitcoin’s liveliness metric (a measure of how much Bitcoin is actively traded versus dormant) has held steady at about 60%. This suggests that roughly 40% of Bitcoin’s total supply might be “vaulted” or lost. When accounting for active supply only, ARK’s experimental models predict price targets 40% higher than their primary forecast.

Risks and Realities

Even with these optimistic figures, ARK acknowledges the risks that could derail their predictions. Chief among them is the uncertainty around broader adoption. If Bitcoin penetration rates stagnate, the price targets might be too ambitious. There’s also the matter of regulatory and geopolitical risks, which could spook potential adopters and investors.

ARK’s projections also assume steady macroeconomic growth and stability. Any major shock to the global financial system (think 2008 crisis levels) might disrupt demand or affect market access.

What Does This Mean for Users?

If you’re just getting into Bitcoin, ARK’s predictions can feel empowering — but also overwhelming. On one hand, their data underscores Bitcoin’s potential as a long-term investment. On the other, there are considerable risks and assumptions at play.

Here’s what you can do now:

- Research Before You Buy: If ARK’s projections have piqued your interest, start by understanding Bitcoin basics (blockchain technology, wallet security, etc.).

- Diversify Your Portfolio: While Bitcoin’s upside may seem alluring, don’t put all your eggs in one basket. Balance your portfolio with other asset classes.

- Follow Regulatory Developments: Spot ETFs and nation-state adoption can greatly impact Bitcoin’s price trajectory. Stay informed about any updates.

ARK Puts Their Money Where Their Mouth Is

ARK Invest’s 2030 Bitcoin projections offer a fascinating lens into where the market could go based on adoption trends and market growth. While the numbers are lofty, the underlying themes point to a clear trend: Bitcoin’s role in global finance is expanding.

The firm isn’t all talk, either. Their BTC ETF (ARKB) holds over 50k BTC. They also acquired another $80 million last month during the last big price dip.

On the personal side, Cathie Wood admitted a while back that, excluding ARK holdings and real estate, Bitcoin makes up about 25% of her personal portfolio. That’s conviction, ladies and gentlemen.

Whether Bitcoin hits $500K or $2.5M, one thing’s for sure — it’s a market people should no longer ignore.