TLDR

- Bitcoin miners are selling BTC lately.

- Some publicly traded companies are selling production and even tapping into reserves.

- Most of them are doing so to fund growth while the market is crabbing.

We have covered major institutional players’ huge BTC purchases. And we’ve done so at length. And multiple times. But there’s another side to that as well. We’re talking about public companies that mine BTC as their primary source of both income and treasury holdings.

Bitcoin miners have started unloading their BTC. If you’re a Bitcoin investor, HODLer, or just crypto-curious, this development might make you wonder why miners switch from holding to selling.

After all, miners are the ones closest to Bitcoin’s production cycle, so their moves often reveal a lot about the health of the industry. Or do they? Let’s get after it.

Miners Selling BTC – The Details

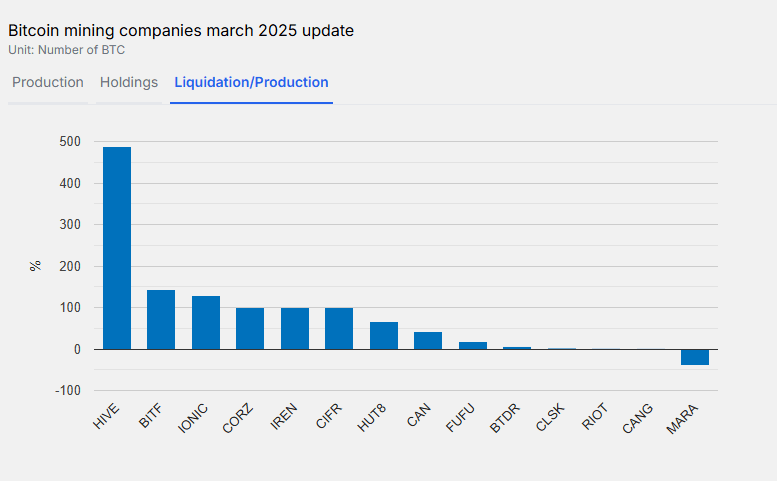

March 2025 brought a sharp turn in how Bitcoin miners operate. Publicly traded mining firms sold over 40% of their monthly Bitcoin production, according to an article from The Miner Mag, a website that tracks data like which companies are selling BTC they mine and which ones are HODLing.

That’s the highest liquidation percentage we’ve seen since October 2024. This uptick is a significant shift from the aggressive HODLing behavior we saw at the beginning of this year when miners were stacking BTC instead of selling.

Note. Many people seem to be overlooking one caveat to this article. These companies are not offloading entire treasuries. They’re dumping what they mined. There’s a pretty big difference between what is happening and how some folks are processing the information.

Why Are Miners Selling?

Several factors are driving this trend, including tightening profit margins, rising operational costs, and market conditions. Let’s break it down:

1. Low Bitcoin Hashprice

The Bitcoin hashprice, which measures mining profitability, is hovering near cycle lows. For miners, that means the reward for mining blocks isn’t great. When hashprice dips, margins shrink, making it harder for mining operations to stay in the green.

Add to that the fact that transaction fees currently make up only 1.1% of block rewards (a historical low), and it’s easy to see why miners might turn to selling their monthly production.

2. Post-Halving Effects

The most recent Bitcoin halving sliced block rewards in half, as expected. While halvings are celebrated for their role in controlling Bitcoin’s supply, they also put financial pressure on miners who see their revenue drop unless Bitcoin’s price rises.

Revenue pressure often leads miners to liquidate some coins to cover their operational expenses. Why? For many companies, mining is their only form of income. Companies have to do the same things the rest of us do — like paying bills, employees, etc…

3. Ramping Up Capital Expenditures

This isn’t just about survival. Some miners are selling Bitcoin to fund growth. Big players like CleanSpark, HIVE, and Bitfarms are building new infrastructure, upgrading their hardware (ASICs), and diversifying into areas like high-performance computing (possibly to get into the AI game, as farming compute power is required for mining BTC and running AI).

These expansions require significant capital, and with Bitcoin prices crabbing, selling reserves becomes an easy way to raise money.

For example, CleanSpark recently announced it’s using Bitcoin-collateralized loans as part of a broader capital strategy. According to CleanSpark CEO Zach Bradford, the company is leveraging its BTC production for operational liquidity while strategically scaling its mining operations.

In a recent press release, Cleanspark Bradford stated, “With our Bitcoin holdings now exceeding 12,000, valued at approximately $1 billion, we believe this is the right time to evolve from a nearly 100% hold strategy adopted in mid-2023 and move back using a portion of our monthly production to support operations…We view our approach as deliberately strategic rather than ideological — particularly now that we’ve reached our current scale. While we remain committed to Bitcoin as a long-term, hardened asset, we believe a more effective way to increase shareholder value is through a balanced approach between monetizing new production and building long-term holdings.”

Not only do publicly traded companies have to pay bills, they also need to make shareholders happy. It’s a bit of a double-edged blade.

A Tale of Two Mining Strategies

Not all miners are following the same playbook. On one side, you have companies like CleanSpark, which view Bitcoin as a strategic asset and are willing to sell some of their production to finance operations and growth. For them, it’s about balance.

On the other side, many miners continue to prioritize HODLing as much Bitcoin as possible, even if it means relying more on equity dilution or debt financing, like MetaPlanet, Strategy, and MARA Holdings are doing.

Who’s Leading the Selling Spree?

Among public mining firms, some have sold significantly more Bitcoin than they’ve mined. HIVE, Bitfarms, and Ionic Digital have liquidated over 100% of their March production, indicating they’re tapping into their reserves to meet their operational needs.

Others, like Riot Platforms and Hut 8, are maintaining more conservative selling strategies, waiting to see if market conditions improve.

What Selling BTC Means for the Market

The increase in miners selling BTC could have mixed implications for the Bitcoin market and its stakeholders:

1. Short-Term Pressure on BTC Prices

When miners liquidate large amounts of Bitcoin, it adds selling pressure to the market, potentially dragging down prices. If you’re holding Bitcoin, this could be a frustrating development, especially if prices remain stagnant or continue to drop.

2. Long-Term Growth in Mining Infrastructure

The flip side is that miners’ capitalization strategies are leading to infrastructure upgrades and industry expansion. While these moves may hurt Bitcoin prices in the short term, they could contribute to the network’s resilience and operational efficiency over time.

3. A Changing Narrative Around HODLing

The days of “never sell” may be evolving. At least to a degree. CleanSpark’s recent pivot away from a nearly 100% HODL strategy reflects a pragmatic approach that could catch on across the mining sector.

It suggests that miners are becoming more strategic about balancing their roles as BTC holders and custodians of the network’s growth.

What Should You Do as an Investor?

Watching mining firms sell Bitcoin at higher rates might set off alarm bells. It may even scare some. But others are licking their lips at a potential opportunity.

It’s important to take a step back and look at the bigger picture. If you’re a long-term investor, short-term miner selling may not have much impact on your overall strategy.

However, it’s worth keeping an eye on metrics like hashprice, transaction fees, and miner liquidation rates. These indicators can give you a sense of where the industry is heading and help you make informed decisions about your investments.

If you’re new to crypto or looking to diversify, now might be a good time to educate yourself further on how mining and Bitcoin’s supply dynamics influence market trends.